Payroll is a critical component of any business that allows us to pay our employees on time, track hours, comply with various laws, and much more. However, QuickBooks error PS038 while updating payroll tax tables or running general processes can make it challenging to manage everything. Either your paychecks are stuck as ‘Online to Send’ and cannot be sent on the Intuit end, or there may be other problems like system security application, any damage to the payroll setup file, and much more. In this blog, we will discuss the possible causes that trigger the error code PS038, related errors, and steps to resolve such errors immediately.

QuickBooks Error PS038: An Overview

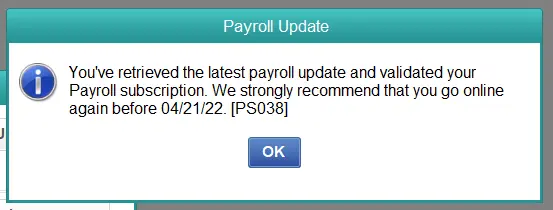

You may encounter the error code PS038 when running payroll, downloading tax table updates, or when your paycheck is stuck as ‘Online to Send.’ The error code appears on your screen along with a warning message

“You have received the latest payroll update and validated your payroll subscription. We strongly recommend that you go online. [PS038]”

The error you are encountering is one of the PSXXX series that can come up for similar reasons mainly when downloading tax table updates. Let’s take a look at the possible errors you may encounter in the same situation. This will help you determine the blockage easily and the troubleshooting solutions below will help you resolve any of these errors.

| QuickBooks Error PS033 | QuickBooks Error PS101 |

| QuickBooks Error PS036 | QuickBooks Error PS107 |

| QuickBooks Error PS032 |

What Triggers Error Code PS038 When Updating or Running Payroll?

Knowing what hampers your payroll update will make it easier to troublehsoot the issues. Let’s explore the possible factors that interrupts the payroll processes or update and triggers QuickBooks error PS038:

- Your paycheck might get stuck and aren’t sent to Intuit.

- Using an outdated version of QuickBooks.

- You might have an inactive payroll subscription.

- The QuickBooks program might not be registered to receive updates

- There might be some damage to the QB file in the CPD folder

- Microsoft Defender might be considered a threat to your computer, blocking the updates.

- Any issue going on with your QuickBooks program can hamper the update.

- Incorrect installation of QuickBooks Desktop

Top 6 Ways to Rectify QuickBooks Error Code PS038 in Payroll

Now familiar with the factors that trigger QuickBooks error PS038 when running payroll or updates? Now, proceed with the section below to uncover the appropriate fixes and ensure you can run payroll and updates without any hindrances.

1. Process your stuck paychecks

Stuck paychecks are those that have been sent on your behalf but Intuit could not process, often marked as “to be sent online.” This usually hinders payroll updates, direct deposits, or paper check processing, causing delays in employee payments.

So, let’s process paychecks by following the steps to ensure you can perform payroll processes on time.

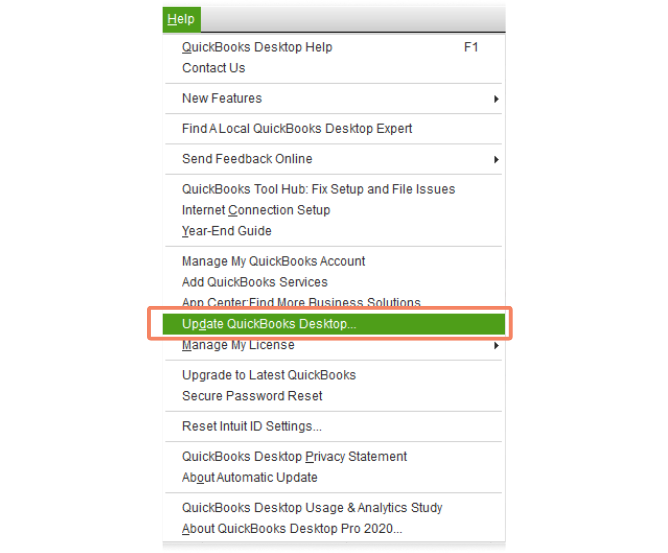

a. Update QuickBooks and create a company file backup

Before proceeding to the below steps, you must ensure your QuickBooks Desktop it up-to-date to the latest release to ensure the outdated program isn’t causing the issues.

To make sure your QuickBooks data is safe when performing the troublehsoting steps, backup your company file data by following the below steps:

- Launch QuickBooks and navigate to the File menu

- Then, click on Switch to Single-user Mode.

- Return to File> Back up Company and then click on Create Local Backup.

- Select Local backup in the prompted window and then Next.

- In the Local Backup Only section, click on Browse and choose the location to save the backup copy.

- Here, you set the number of backup copy you want (optional). Tip: You don’t need to worry about the backup or pencil it on your calender. Select the options in the Online and Local Backup section to set backup reminders.

- This will run a quick testto ensrue that your company file is in good hape.

- Click OK when you’re ready to create a backup.

- Choose Save it now and then Next.

This way QuickBooks will create a single backup copy. Once all done, you will receive a confirmation message.

b. Send your payroll data or usage data

- Select Employees at the top menu bar> My Payroll Service, then click on Send Usage Data. If you don’t this option, follow the below steps.

- Go to Employees at the top, then select Send Payroll Data.

- Choose Send All in the prompted Send/Receive Payroll Data window. Enter the payroll service PIN when prompted.

If you send the paychecks successfully, try to get payroll updates again. If you still see the error, proceed to the next steps.

c. Identify stuck paychecks

The steps below will help you identify paychecks that have not been sent to Intuit:

- Select Edit from the top menu bar> Find.

- Navigate to the Advanced tab.

- Scroll down to the Choose Filter section, select Detail Level from the Filter list.

- Hit on Summary Only.

- Move back to the Filter list.

- Now, scroll down to select Online Status, then select Online to Send.

- Select Find and the paychecks that aren’t sent to Intuit will display.

- Note down the “Number of matches” on the Find window. Proceed to Step 4.

Read More: QuickBooks Error 15276

d. Verify and Rebuild your data

Running the Verify and Rebuild Data utility helps you eliminate potential data corruption or errors that might prevent payroll processing, ensure accurate and timely payments, fix QuickBooks error PS038.

Verifying the company file data

- Navigate to Window and select Close All.

- Go to File and then select Utilities.

- Click on Verify Data. Now, you will see: – QuickBooks detected no problems with your data—There is no issue found, your data is clean and you don’t need to do anything else. – An error message—Search for it on our official website or connect with experts for consultation. – Your data has lost integrity—Data damage is found and you must rebuild them.

Rebuilding the data damages

- Go to File at the top and select Utilities. Then, click on Rebuild Data.

- Now, you will be asked to cearte a backup before reuilding the data damages. Click OK as a backup is required before you can rebuild.

- Choose the location to save the backup copy and click OK. Make sure you are not replacing any existing file. Enter a new name in the file name section and choose Save.

- Click OK when you receive a message syaing Rebuild has completed.

e. Toggle the Stuck Paychecks

Toggling stuck paychecks in QuickBooks, often a fix for error PS038, involves opening the oldest stuck paycheck, adding a duplicate earnings item, and then deleting it, which forces QuickBooks to reprocess the payroll data.

- Find the oldest stuck paycheck and open it.

- Hit the Paycheck Detail button.

- Scroll down to Earnings in the Review Paycheck window, and add the same earnings item as your last earning itme in the list. Example: In case the last itme in the list is Horuly Rate, you need to another item named as Horuly rate in the list.

- Click OK when you see a Net Pay Locked message.

- Be sure not to make any changes to the tax amounts and net pay, then click OK.

- Select Yes only if you receive a Past Transaction message.

- Click Save & Close to close the paycheck.

2. Check your Payroll Subscription

To ensure you can receive payroll updates, it is necessary to have an active payroll subscription. If you have an active subscription, follow the steps below to get it:

- Exit all the company files and then restart your computer.

- Launch QuickBooks and go to Employees> My Payroll Service, then select Manage Service Key.

- Make sure the Service Name and Status are correct show as Active.

- Click Edit and then verify the service key number. In case the service key is incorrect, enter the correct service key.

- Select next and uncheck the Open Payroll Setup box. Then, click Finish.

- This will download the entire payroll update.

3. Register your QuickBooks

If your program is not regsitered, you won’t be getting any secruity or feature enhancements. Let’s confirm whether the sofwtare is regsitered:

- Press F2 key on your keyboard to launch the Product Information window.

- Check if it says Activated beside the license.

If it’s not, register QuickBooks Desktop by following the below steps:

- Launch QB Desktop.

- Choose Activate QuickBooks Desktop from the Help menu.

- Adhere to the on-screen steps to verify your info.

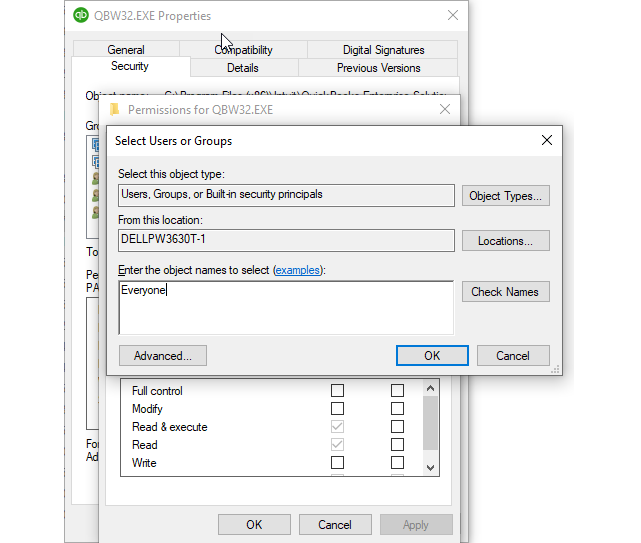

4. Repair file in the CPS Folder

The CPS folder is a payroll setup folder, any damage to the QuickBooks company file can disrupt your payroll updates. Let’s do a quick repair of the file in the CPS folder by following the steps below:

- Onyour keyboard, press the Windows+X keys together.

- Now, choose Command Prompt (Admin) from the menu.

- Click Yes on the User Account Control prompt on your screen.

- In the command prompt, type SFC/scannow and hit Enter.

- The System File Chcker will automatically verify the integrity of Windows system file and repair them if needed.

- After this is done, reboot your computer.

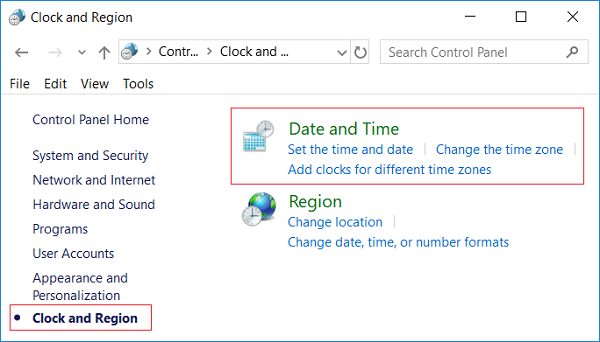

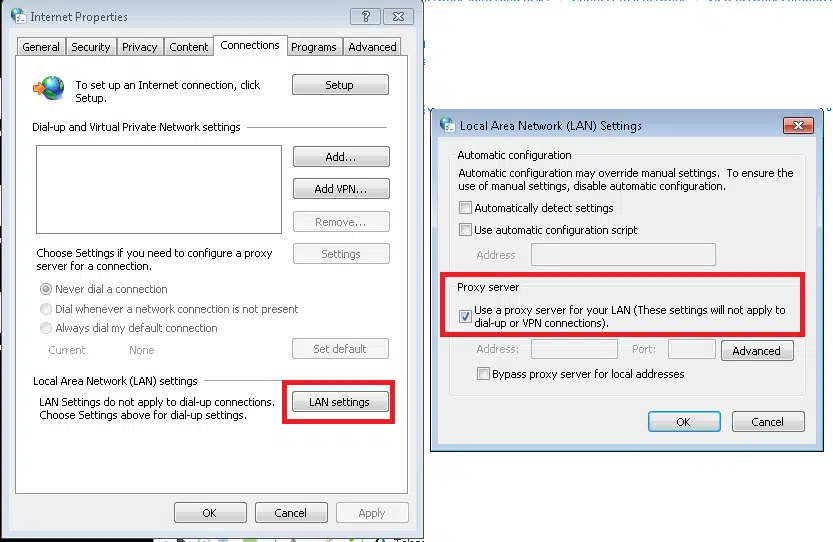

5. Add Defender Exclusion

Windows Defender is the most common software, as it is included with Microsoft Windows. If you are seeing QuickBooks error PS038 when downloading payroll tax table updates or when running a service, there are two options to resolve this issue.

a. Create a Microsoft Defender exclusion of QuickBooks files

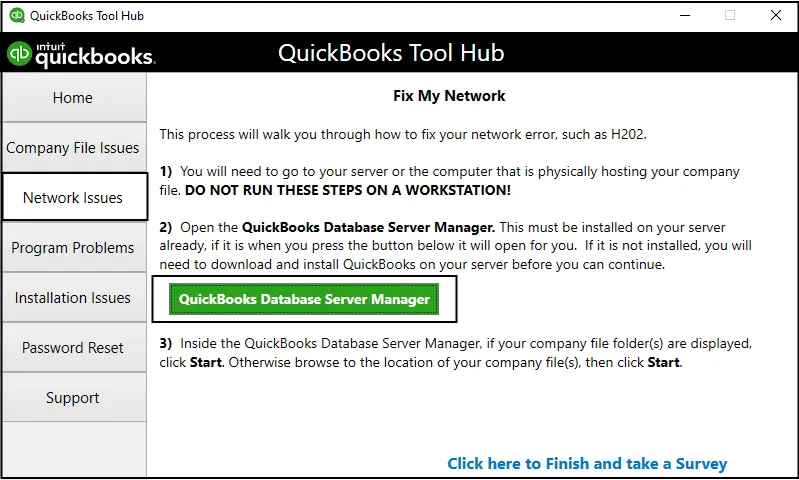

To help you solve this problem, QuickBooks Tool Hub has introduced a new feature that lets you create an exclusion for specific QuickBooks files.

When you do this, the Microsoft Defender on your system will no longer scan them during installation and allow you to update them automatically to keep them moving at their expected speed. To use this feature, follow the steps below:

Note: To add Exclusions, you need to be logged in as an administrator. You will need to ask your administrator to add an exclusion for you if the Add Defender Exclusion option is grayed out and you are not the computer’s administrator.

- Click Cancel to stop the payroll update.

- Exit QuickBooks Desktop.

- Launch your QuickBooks Tool Hub.

- Select Installation Issues from the left pane.

- Hit on Add Defender Exclusion.

- Now, restart your computer.

- Launch QuickBooks and start the payroll update.

b. Turn off Windows Defender Antivirus Protection

- Hit on Cancel to stop the update.

- Exit QuickBooks Desktop.

- Disbale the Defender antivirus protection in Windows Security.

- Open QuickBooks again and restart the update.

Once the update is finished, ensure to enable the Windows Defender to keep your system protected.

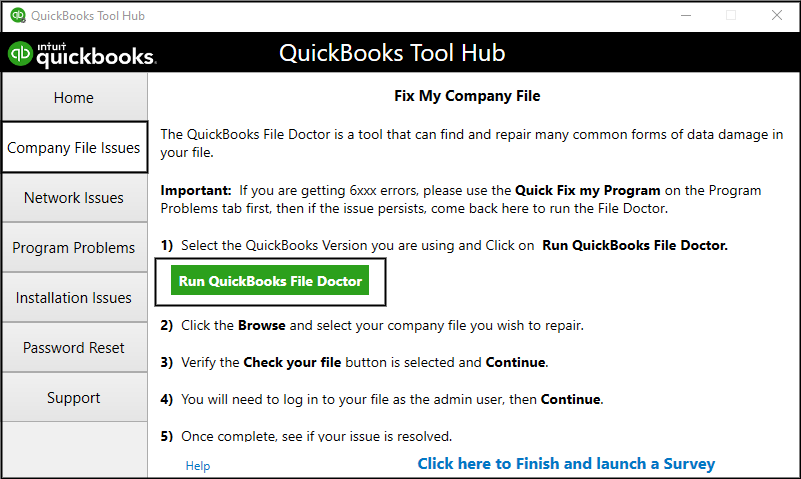

6. Repair your QuickBooks Program

Any problems that occur in your QuickBooks program can disrupt your updates, normal operations and trigger the error code PS038 or any other problem. To fix the problems, try running different tools to fix the problem and ensure a seamless user-experience.

a. Run Quick Fix my Program

The Quick Fix will shutdown all the processes running in the background and runs a quick repair to your program. Let’s see how to make use of the tool:

- Launch QuickBooks Tool Hub and go to Program Problems.

- Hit on Quick Fix my Program.

- Launch QuickBooks Desktop and open your data file.

b. Run QuickBooks Install Diagnostic Tool

If something goes wrong during the QuickBooks installation, it can cause problems when you use it, such as when running or updating the payroll services. Run the QuickBooks Install Diagnostic Tool to fix common install problems.

- Launch QuickBooks Tool Hub and click on Installation Issues.

- Hit on QuickBooks Install Diagnostic Tool. The tool might take up to 20 minutes to finish; wait until then.

- Once done, restart your computer and start QuickBooks Desktop, then open your data file.

- Download the QuickBooks Desktop update to ensure you have the most recent fixes and security update.

7. Re-install QuickBooks Desktop

Reinstalling QuickBooks Desktop removes the old program files and then reinstalls them, which should resolve related issues or errors you may be encountering due to similar factors.

Before starting the reinstallation

- Get the installer version of your QuickBooks Desktop.

- Keep the license number handy. You can find it on the original package or in your confirmation email if you bought it online.

a. Remove QuickBooks

- Press the Windows logo to launch the Windows Start menu.

- Search for Control Panel in the search bar and hit the Enter key.

- This will open Control Panel on your screen.

- Choose Programs and Features or click on Uninstall a Program.

- Now, choose the QuickBooks version you want to uninstall from the list of programs.

- Hit on Uninstall/Change, Remove and then Next. If you don’t the option to remove the program, sign out and then sign in again as an admin.

Read Also: Update QuickBooks Desktop to the Latest Version

b. Install QuickBooks Desktop Again

Once all done, install your QuickBooks Desktop again. When doing so, QuickBooks will automatically install the new folders and rename the old ones.

- Make sure your compauter has an active internet connection.

- Locate the QuickBooks program file QuickBooks.exe

- Now, choose – Express install – This option will save all the preferneces and install over the previosuly installed version of QuickBooks. To reinstall the previous version, you will need to use the custom reinstall. – Custom and Network Options – This will help you install the new verison on a different locaiton and keep the previous version installed. The newer version will not add the prior version preferences.

- Select Next and then click on Install.

- When it finishes, select Open QuickBooks.

Summary

We know how important it is to keep payroll services running and updated to maintain compliance, pay your employees on time, and other related processes. However, interruptions like QuickBooks error PS038 can make it challenging to run even basic processes. The information provided in the above article will help you resolve the error immediately.

For further assistance, you can contact our QuickBooks team who are available 24/7 to assist you. Dial +1(866)408-0544 and connect with ProAdvisor now!

FAQ

How to fix QuickBooks error PS038?

Update and backup your QuickBooks data and send your payroll data or usage data. Now, identify your stuck paychecks and run the Verify and Rebuild Data utility and finally toggle to send the stuck paychecks to Intuit.

What is error code PS038 in QuickBooks?

When running payroll or trying to update services, you may encounter the error code PS038 in QuickBooks, mainly caused by stuck paychecks, using an outdated version of QuickBooks, not having an active payroll subscription, and if your QuickBooks program is not registered to receive the updates.

How do I update payroll in QuickBooks Desktop?

Proceed with the below steps to learn how to update the payroll services:

- Navigate to Employees and click on Get Payroll Updates.

- Hit on Payroll Update Info.

What is Payroll Error PS0XX in QuickBooks Desktop?

In QuickBooks Desktop, payroll error PS0XX usually indicates problems while running payroll or updating services. This occurs when you don’t have an active payroll subscription or is caused by incorrect employee or vendor data, corrupt files, or out-of-date software, which require specific troubleshooting steps to resolve.

How do I send payroll data to intuit?

To send payroll data from QuickBooks desktop to Intuit, you must enable payroll features in QuickBooks, then either use the built-in payroll functionality or integrate with QuickBooks Online Payroll for more comprehensive options.