Discover How to Get the QuickBooks Payroll Tax Table Update

To enjoy the seamless QuickBooks Payroll experience, the latest QuickBooks Payroll Tax Table update must be installed. By accessing the latest tax table update, you can receive the up-to-date, accurate rates for the federal and supported state taxes. However, users must have a valid and active payroll subscription to get the latest payroll update.

If you are looking for the proper guide to provide the stepwise procedure for installing the latest payroll updates, this is the post you are looking for. In this post, you will get all the necessary details for a smooth payroll experience in QB.

Are you having issues while installing the QuickBooks Payroll tax table update without any technical experience? If yes, consult with our QB professionals at +1(866)408-0544 and they will assist you in the best possible way.

Basic Necessities You Must Have Before Getting QuickBooks Payroll Tax Table Update

To successfully download the QuickBooks Payroll tax table update on your operating system, you must fulfill the following prerequisites. To learn about them in detail, thoroughly review the points below.

Legitimate and Active Payroll Subscription:-

An authentic and valid payroll subscription is required to update payroll tax tables in QuickBooks. To check the status of the payroll subscription, use the Ctrl + 1 keys to access the Product Information window and get all the relevant details.

Stable and High-Speed Internet Connection:-

Another important requirement while updating the latest tax table in QuickBooks is a good internet network connection. If your network connection is having issues, ask your ISP to fix it immediately.

Get the Updated Version of QuickBooks Desktop:-

Moreover, users must also require the newly launched version of QuickBooks Desktop to get the latest payroll updates.

Download the Updates Within 45 days:-

Experts recommend that users download the latest tax table updates within 45 days. Alternatively, you may also get it updated when the payment is made to the employees.

Read More: QuickBooks Payroll Update Not Working

Which is the latest QuickBooks Payroll Tax Table Update Available? QuickBooks Payroll Disappeared

The latest QuickBooks Payroll tax table update version is 11934004, introduced on June 18, 2024. This recently launched version will be in effect from July 1, 2024, to December 31, 2024.

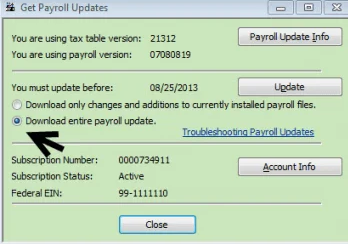

How can I Determine the Version of Your Current Payroll Tax Table?

To identify which version of the current payroll tax table you are accessing, follow the stepwise instructions below.

- To begin the process, navigate to the QuickBooks Employees menu and click My Payroll Service.

- Moving ahead, tap on the highlighted Tax Table Information option.

- Soon after this, you will notice that the first three numbers of the payroll tax table are reflected in “You are using tax table version.” Also, you must verify that the number must be “11934004”.

- If you see that the current version is “11934004,” it means that your product is already up to date.

Note: The users must confirm that they are working on the QuickBooks Desktop 2024 or QuickBooks Desktop Enterprise Solutions 24.0 to get this payroll tax table update.

How to Update Payroll Tax Table in QuickBooks Desktop?- Expert’s Tips

Users must follow the following steps to download the latest updated payroll tax table in QuickBooks Desktop. With the latest payroll updates, it gets easier to compute the payroll according to the latest tax table return.

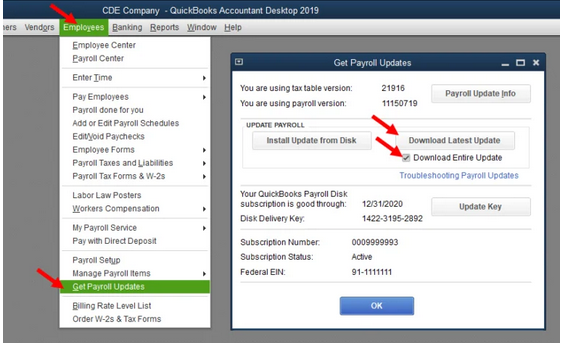

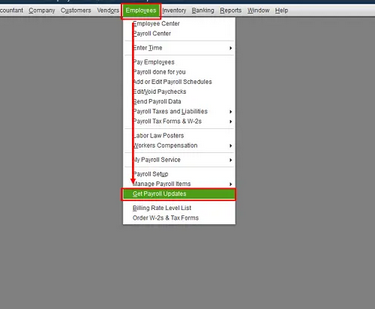

- In the primary stage, navigate to the QuickBooks Employees menu and choose Get Payroll Updates.

- Confirm that the “Download Entire Update” checkbox from the upcoming window has been selected.

- Once you have made the necessary changes, tap the Download Latest Update option.

- Finally, a window will appear on your computer screen once the QuickBooks payroll tax table update is downloaded.

How to Update QuickBooks Payroll Tax Tables From a CD?

Herein, we have described the step-by-step instructions to update QuickBooks payroll tax tables from a CD. Let’s thoroughly review the instructions below and download the latest updates without any interference.

First Stage: Mention the Service and Disk Delivery Keys

If you don’t have the service key previously, you can utilize the automated service and disk delivery tools in that scenario. Alternatively, you may log in to the Intuit account with the correct sign-in details.

- Begin the process by clicking the QuickBooks Employees menu and then the Payroll tab.

- After that, you must include the “Payroll Service Key” within the search panel.

- Thereon, go with the highlighted “Add” option beside the QuickBooks service sign-up screen.

- In the next step, you must mention the service key to continue.

- Once you finish the steps, Enter the delivery key and tap the Next button to conclude the process.

Second Stage: Get the Latest Tax Table Updates Installed From Your CD

- In the initial stage, you must install the CD into your system’s CD drive.

- After this, navigate to the QuickBooks Employees menu and select the Get Payroll Updates option to continue with the process.

3. Once you all set, tap on the Install Update from disk option and click the Install option to complete the entire process.

What Things Are Included in Current Payroll Tax Table Update in QuickBooks?

You must review the table below to check the current and historical TD1, CPP, and EI amounts for the payroll tax table update in 2024.

| Effective Date | 7/1/2024 | 1/1/2024 |

| Tax Table version # | 11934004 | 11933003 |

| TD1 Amounts | ||

| Federal | 15,705 | 15,705 |

| AB | 21,885 | 21,885 |

| BC | 12,580 | 12,580 |

| MB | 15,780 | 15,780 |

| NB | 13,044 | 13,044 |

| NL | 10,818 | 10,818 |

| NS | 11,481 | 11,481 |

| NT | 17,373 | 17,373 |

| NU | 18,767 | 18,767 |

| ON | 12,399 | 12,399 |

| PE | 13,500 | 13,500 |

| QC | 18,056 | 18,056 |

| SK | 18,491 | 18,491 |

| YT | 15,705 | 15,705 |

| ZZ (Employees outside Canada) | 0 | 0 |

| Effective Date | 7/1/2024 | 1/1/2024 |

| Tax Table Version | 11934004 | 11833003 |

| Canada Pension Plan (CPP)- outside Quebec | ||

| Maximum Pensionable Earnings | 68,500 | 68,500 |

| Basic Exemption | 3,500 | 3,500 |

| Contribution Rate | 5.95% | 5.95% |

| Maximum Contribution (EE) | 3,867.50 | 3,867.50 |

| Maximum Contribution (ER) | 3,867.50 | 3,867.50 |

| Employment Insurance (EI)- outside Quebec | ||

| Maximum Insurable Earnings | 63,200 | 63,200 |

| Premium EI Rate (EE) | 1.660% | 1.660% |

| Premium EI Rate (ER) (1.4*EE) | 2.324% | 2.324% |

| Maximum Premium (EE) | 1,049.12 | 1,049.12 |

| Maximum Premium (ER) | 1,468.77 | 1,468.77 |

| Effective Date | 7/01/2024 | 1/1/2024 |

| Tax Table Version # | 11934004 | 11833003 |

| Quebec Pension Plan (QPP) | ||

| Maximum Pensionable Earnings | 68,500 | 68,500 |

| Basic Exemption | 3,500 | 3,500 |

| Contribution Rate | 6.40% | 6040% |

| Maximum Contribution (EE) | 4,160 | 4,160 |

| Maximum Contribution (ER) | 4,160 | 4,160 |

| Employment Insurance (EI- Quebec Only) | ||

| Maximum Insurable Earnings | 63,200 | 63,200 |

| Premium EI Rate | 1.320% | 1.320% |

| Premium EI Rate (ER) (1.4*EE) | 1.848% | 1.848% |

| Maximum Premium (EE) | 834.24 | 834.24 |

| Maximum Premium (ER) (1.4*EE) | 1,167.94 | 1,167.94 |

| Quebec Parental Insurance Plan (QPIP) | ||

| Maximum Insurable earnings | 94,000 | 94,000 |

| Contribution Rate (EE) | 0.494% | 0.494% |

| Contribution Rate (ER) (1.4*EE) | 0.692% | 0.692% |

| Maximum Contribution (EE) | 464.36 | 464.36 |

| Maximum Contribution (ER) (1.4*EE) | 650.48 | 650.48 |

| Commission des normes du travail (CNT) | ||

| Maximum Earnings subject to CNT | 94,000 | 94,000 |

| Contribution rate (EE) | 0.494% | 0.494% |

| Contribution Rate (ER) (1.4*EE) | 0.692% | 0.692% |

| Maximum Contribution (EE) | 464.36 | 464.36 |

| Maximum Contribution (ER) (1.4*EE) | 650.48 | 650.48 |

| Commission des normes du travail (CNT) | ||

| Maximum Earnings subject to CNT | 94,000 | 94,000 |

Rectifying the Payroll Update Issues After Updating QuickBooks Tax Table Updates

For instance, if you haven’t updated the TD1 tax amounts even after installing QuickBooks’s latest tax table updates.

- The users must verify that the tax table is effective on or after June 18, 2024 and that the downloaded version is 11934004. In short, if you downloaded the tax table version on June 18, 2024, then the amount will not represented until it becomes effective from July 1, 2024.

- When you adjust the TD1 amounts for an employee, the new tax table will not change the already adjusted amounts. To do so, you only need to update the TD1 amounts going forward manually.

- In addition, the QuickBooks software will update the TD1 amounts for only those employees with basic amounts from last year’s tax tables.

Also Read: QuickBooks Payroll Disappeared

Explaining About the Different Payroll Tax Table Update Errors in QuickBooks

Users might discover numerous technical bugs while getting QuickBooks’s latest payroll tax table update. Below, we have briefly explained all such issues; check them out.

Payroll Error PS038:-

Users often report QuickBooks Payroll Error PS038 while running the payroll or downloading the latest tax table update. In other instances, users may see this error when they notice that the paychecks get stuck in “Online To Send.” So, to fix the issue, it is mandatory to run the Verify and Rebuild Data tool.

QuickBooks PSXXX Series of Error:-

Sometimes, users encounter a PSXXX series of errors in QuickBooks, like PS033, PS101, PS107, and PS036, while downloading the latest payroll updates. This issue generally arises due to misconfigured internet settings or damage to the CPS folder. Therefore, to rectify the issue, you must change the IE settings and try running the Quick Fix My Program tool.

QuickBooks 15XXX Series of Error:-

The 15XXX aries of error in QuickBooks mainly pops up on the user’s screen while downloading the latest available tax table update. These errors might include QuickBooks Error 15102, QuickBooks Error Code 15212, QuickBooks Error 15270, etc. However, this error may arise for multiple reasons, such as incorrect IE settings, missing file components for payroll updates, or interruptions from the Windows firewall.

Read More: QuickBooks Error 15225

UEXP Errors in QuickBooks:-

The UEXP errors in QuickBooks mainly appear on the user’s screen while trying to download the latest payroll updates. In other instances, they might arise while activating the retail payroll in QuickBooks Desktop. The main reason behind the error’s occurrence is using an older version of QuickBooks or the payroll subscription. So, to fix the issue, it is crucial to download the latest payroll tax table.

Summarizing the Above!!

We hope you can easily get the latest QuickBooks Payroll Tax Table Update and accurately compute state and federal taxes. If you require additional help regarding the QuickBooks payroll updates, contact our professionals at +1(866)408-0544 for instant relief.

Recent Posts

Get Started with QuickBooks Payroll Setup For Easy Tax Filing

Read MoreRun QuickBooks For Small Business & Simplify Your Finances

Read MoreEasy Steps to Download QuickBooks Tool Hub (1.6.0.8) For Free

Read MoreFix QuickBooks Online Login issue: Regain Access to Account

Read MoreSuspense Account in QuickBooks Online | Create, Configure & Use

Read More