Here's the Revolutionary QuickBooks Payroll Software 2024

To all the QuickBooks payroll users, the QuickBooks payroll software 2024 has arrived. The buzz has already created Amazon, the daily QuickBooks users, and payroll managers. And the latest software edition is indeed going to revolutionize payroll management. We understand how excited you must be to learn this latest program’s exciting features and functionality. That’s why we have come up with this comprehensive post to guide you through everything about this latest launch. Here we go!

Are you excited to learn about the latest QuickBooks features and accessibilities? If so, contact us at +1-844-248-9739 and our professionals will help you.

QuickBooks Payroll Software 2024 - A Quick Review!

The recently launched QuickBooks payroll software 2024 will be truly revolutionary for payroll managers and daily QuickBooks users. By establishing a new norm in the payroll industry, the software redefines efficiency, optimizes profits, and simplifies payroll management like never before. We can confidently say that this newest innovation is going to be the reason for business stability with maximum payroll efficiency. Now, let’s quickly talk about the latest features you can access while using this software.

Trendsetting Features of Intuit QuickBooks Payroll Software 2024

The excellent cloud-based Intuit QuickBooks payroll software 2024 is available both as stand-alone and integrated with QuickBooks online. Talking about the features and functionalities of this 2024 edition, undoubtedly, users are going to have an enhanced experience while accessing them. Have a look:

Indeed! Users who are going to install the latest QuickBooks payroll 2024 edition will experience unparalleled analytics and reporting. With this, users can manage around 20 reports, including payroll deductions and contributions, payroll tax liability, payroll billing summary, employee’s compensation and total pay, etc. Here, users have the flexibility to edit these reports before finally running them. Within a few clicks, users can access these reports, export them to MS Excel, and print them, too.

Intuit has introduced a time-tracking app named QuickBooks Time, and now, with the Intuit QuickBooks payroll software 2024 edition, users can track their payroll processing in real time. Both the QuickBooks payroll premium and Elite 2024 editions have this facility. Also, you can integrate this feature into other applications as well to maintain the workflow seamlessly.

Recently, Intuit has added access to the QuickBooks payroll software, which is the one-time live setup support feature. Users with QuickBooks 2024 online payroll software can access this top-notch feature. It’s a top-tier QuickBooks online plan, and the new edition offers expert reviews to the users while taking live support. Here, users can opt for a 30-day free trial or access one-time live support within the first 30 days after purchasing the QuickBooks payroll software 2024.

Well, we can say stress-free year-end tax filings while using QuickBooks payroll software edition 2024. With the help of this latest edition, you can enjoy automation while calculating, filing, and paying all the federal and state payroll taxes. Now, the tax season won’t be a stress season anymore, as all the essential tax forms for your regular employees and contractors are automatically generated. If you purchase QuickBooks Core 2024 or Premium 2024, the tax filing services are free for you.

As discussed above, the QuickBooks payroll software allows users to track their payroll processing in real time. Along with this, they can easily run Payroll, fill out and submit tax forms, and pay taxes before the deadline. But, it’s not enough; users must stay updated with the payroll compliance information to avoid any penalties or further problems. That’s why QuickBooks 2024 payroll edition provides all the required information to the users, including labor laws, payroll compliance, social security standards, employees’ compensations, exemptions, and much more.

Versions of QuickBooks Payroll Software for Small Businesses

The fact that QuickBooks is an outstanding accounting program for all mall and medium-sized businesses is hidden from anyone. But every business has its own running model and way of payroll management. That’s why Intuit has different versions of QuickBooks payroll software available for small businesses as per their requirements. So, let’s have a look and learn how they’re gonna support users in 2024 and beyond.

The QuickBooks Core version is basically an online payroll plan by Intuit’s QuickBooks and the cheapest plan suitable for both small and medium-sized businesses with simple payroll requirements. From automated Payroll, expert product support, and automatic federal and state tax forms filing to next-day direct deposits, this Core 2024 edition is going to enhance your payroll management. With this, you can leverage the following benefits:

Full-service Payroll

Automated Tax filing and submission

Expert product support

Accurate and hassle-free Payroll

Health benefits enroll

24/7 live chat support

Telephonic support from Mon-Fri between 6 am-6 pm and Sat between 6 am-3 pm PT

The next QuickBooks version of payroll software for small businesses is QuickBooks Premium. So, it’s a top-tier edition taking users up a notch and has upper-level payroll plans for businesses with extra needs. This premium edition includes tracking employee’s working hours, managing projects, generating automated reports, handling challenging job-costing tasks, and much more. Now, while setting up this Premium Payroll QuickBooks program, you get an expert review and support to ensure everything is perfectly organized. Once successfully installed, you get the following perks with it:

Same-day direct deposit

Real-time tracking integration feature

Professional round-the-clock support

Assistance with HR compliance

Automated local tax filing

Tax-penalty protection

24/7 live chat support

Telephonic support from Mon-Fri between 6 am-6 pm and Sat between 6 am-3 pm PT

Another QuickBooks payroll online software version is the Elite one. It’s also considered a top-tier payroll management solution, having upper-level payroll plans for small and medium businesses. Whatever features and utilities you get with QuickBooks payroll premium, you can find the same in Elite as well, along with the added features. If you’re looking for something that can help you track billable shits and hours, the QuickBooks Payroll Elite is perfect. Below are the available perks that you can enjoy with this edition.

Time tracking, along with geofencing and project planning

Free support from QuickBooks payroll professionals

Free direct deposits and instant paychecks

US-based Elite product support

In-built payroll calculator for quick and accurate tax calculations

Personal HR advisor

Tax penalty protection

24*7 live chat and phone support

Don’t Know How To Utilize QuickBooks Payroll 2024 And Require Expert Supervision? Contact @ +1-844-248-9739 And Talk To Our Certified Professionals To Fix Your Issues.

QuickBooks Payroll Software 2024 Download & Installation

Here’s the quick QuickBooks payroll software download and installation procedure for the latest 2024 edition. Get the software in and start improvising your business from now on and beyond.

Option 1 - Direct Upgrade from the Current QuickBooks Payroll Program

Firstly, log in to your account and directly navigate to the Downloads & Updates page.

Moving on, you will be asked to choose your Country, QuickBooks payroll product, and version.

In the next step, hit the Download dropdown icon and select the payroll version you wish to upgrade.

Now, hit the Upgrade Now button, and choose the Keep old version on my computer option. (select this alternative if you wish to keep your current QuickBooks payroll software)

Done? After this, click the Let’s Go button and continue the QuickBooks payroll software download 2024.

Once the upgrade is over, open the newly updated version and start running the 2024 QuickBooks payroll program.

Option 2 - Download & Install from the Website

Firstly, move to your Internet Browser and open the official Intuit QuickBooks website.

In the next step, directly download the QuickBooks.exe installer file available for the latest 2024 edition.

Now, once the installer file is downloaded, save it on your computer and double-click the file to open it.

Here, you will see on-screen instructions that you must perform to begin the installation of QuickBooks Desktop payroll software.

After performing all the instructions, agree to the license agreement by hitting the Accept box.

Begin the installation by pressing the Install button. Once it’s completed, click the Finish button.

With the successful download and installation of the QuickBooks 2024 Desktop software, you can access the payroll services and run them as per your business needs.

QuickBooks Payroll Software for Mac - Download & Installation

Follow the steps below and download plus install the 2024 QuickBooks payroll software for Mac.

Initially, you must go to the internet browser and open the QuickBooks product download page.

Here, click the download link to the QuickBooks 2024 Desktop software and follow the instructions appearing on the screen.

Once you complete all the instructions, a message will appear on your screen, “An older item named “QuickBooks” already exists in this location. Do you want to replace it with the newer one you’re moving?”

So, you must choose the Replace button and continue launching the latest QuickBooks Desktop payroll software 2024 for Mac.

For this, hit the Finder icon at the bottom-left corner of your Mac screen. Now, choose the Applications folder, having all the programs installed on your Mac.

Now, you must get a message reading, “QuickBooks wants to use your confidential information stored in Intuit ID… in your keychain.” By this message it simply conveys that MacOS is validating the new application.

You can prevent this message on your screen from appearing repeatedly by just entering your login credentials and choosing the Always Allow button.

So, by this, you successfully set up the new 2024 edition of QuickBooks payroll software for Mac.

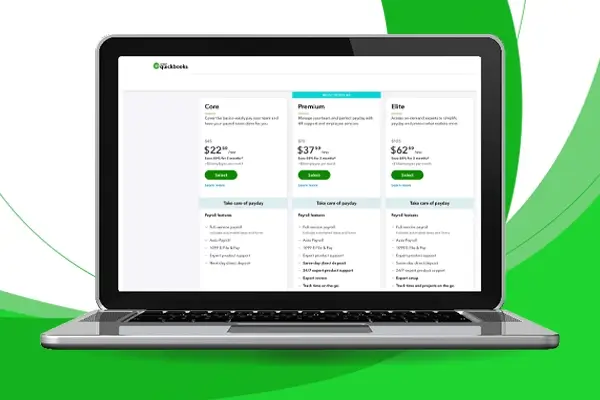

QuickBooks Payroll Software Cost - Pricing Plans for 2024 Edition

Below, we have listed the pricing plans of different 2024 versions of QuickBooks payroll software costs. Have a look at the table below and pick the one that suits your business the best:

It will cost you $45/month + $8/employee/month.

For small businesses have simple requirements.

The price is $80/month + $8/employee/month.

It’s a top-tier software program with level-up features.

The 1099 E-file for employees and time-tracking is available here.

|

What Perks to Avail From QuickBooks Payroll Software 2024?

Intuit is habitually enhancing QuickBooks users’ experience every time the new editions are launched. This time, we are discussing the latest QuickBooks payroll software 2024. So continue scrolling down and learn what payroll perks you can enjoy with this edition:

Seamless and hassle-free Integration

Now, easily connect your required third-party application programs with QuickBooks Payroll 2024 edition. This all-in-one solution software has integration options to simplify your entire payroll and accounting operations.

User-friendly Interface with easy navigation

Though it’s a new software edition with trendsetting features, it boasts a user-friendly interface with easy access and navigation that simplifies your payroll processing. Additionally, if you are a newbie with little accounting experience, operating this newest edition is as easy as a breeze.

Automatic and Accurate Tax Calculations

As discussed enough about all the 2024 latest QuickBooks payroll software versions, users can get automated functionality while calculating, filing, and paying local, state, and federal taxes. Eventually, it reduces the chances of errors.

Same-day or Next-day Direct deposits

This one is one of the most favorable ones. The latest QuickBooks payroll program 2024 offers users fast direct deposit options. Also, it allows for next-day direct deposits under the Core payroll plan and same-day pay under higher plans like Premium and Elite.

Reach Out to Us for Further Help..!

So, that’s all with this comprehensive blog post. We hope the insights above have helped you learn much about the latest QuickBooks payroll software 2024. However, if you need further information regarding this latest program or its pricing, just get in touch with our professionals via Live Chat Support. We will try our best to answer all your queries.

Frequently Asked Questions (FAQs)

What’s new about the QuickBooks Enhanced payroll software 2024?

The latest QuickBooks enhanced payroll software 2024 is a desktop version and helps users fill, submit, and calculate their federal and state payroll taxes. Also, it helps them keep tracking the tax payments. With this, you can also file, submit, and pay the necessary payroll taxes online from QuickBooks online via e-file.

Question 2 – What’s the pricing plan of Payroll Core + QuickBooks Simple Start?

For purchasing Payroll Core + QuickBooks Simple Start, the QuickBooks payroll software cost is $70 per month.

Question 3 – How can I run Payroll in the QuickBooks online application?

Carefully follow the instructions below and seamlessly run your Payroll in the QuickBooks online application:

Open QuickBooks, and go to Payroll.

Here, enter Year-to-Date Information.

Now, enter your Payroll Information.

Further, Input Other Employee Data.

Now, Double-Check and Generate Paychecks.

Finally, Confirm and submit the Payroll.

Ensure the paycheck is saved in the records.

Question 4 – What shall I do to approach professionals while setting up the QuickBooks payroll software 2024?

Just connect with our expert QuickBooks support team at +1-844-248-9739or reach out to us via the available Live Chat Support option.

Question 5 – Are QuickBooks Payroll updates essential while managing Payroll?

Intuit frequently updates QuickBooks payroll software. And you must be updated with the latest innovations and improvisations. Eventually, you will receive notifications for the software upgrades, which are undoubtedly important. These may include the latest changes to tax forms or payroll regulations and sometimes the improvements plus security standards of your current software version as well.

Trusted Payroll from Payday to Tax Time

The QuickBooks Payroll streamlines the task of filing taxes and processing them. Thus, it also reduces the burden of the users to handle all the tax-related tasks alone. You must read the pointers below to learn more about the benefits of filing taxes.

- QuickBooks Payroll helps small and medium-scale businesses in tax preparation and tax filing.

- Also, it helps businesses in filing state and federal taxes.

- Now, you don’t have to worry much about late tax filings; it processes the payroll on time.

- Moreover, it also helps businesses from paying heavy tax penalties on late tax filings.

Affordable QuickBooks Payroll Pricing Plans for Small & Medium Scale Businesses

Here, we have described the pricing plans of QuickBooks small and medium-scale businesses; check them out.

- QuickBooks Payroll Core + Simple Start:- You need to pay $37 monthly and $6 monthly for every employee.

- QuickBooks Payroll Premium Simple Start:- The users must pay $55 monthly and $8 per employee monthly.

- QuickBooks Payroll Premium + Essentials:– To buy this edition, you need to pay $70 monthly and additional charges of $ 8 per employee every month.

- QuickBooks Simple Start:- This subscription plan charges $15 monthly charges.

- QuickBooks Essentials:- The individual has to pay $30 monthly charges.

- QuickBooks Plus:- To get this edition on your device, you must pay $45 monthly.

- QuickBooks Advanced:- The users must pay $100 monthly charges.

Don’t Know How To Utilize QuickBooks Payroll 2024 And Require Expert Supervision? Contact @ +1-844-248-9739 And Talk To Our Certified Professionals To Fix Your Issues.

What You Can Do Beyond Paycheck with QuickBooks Payroll?

With the help of the QuickBooks Payroll feature, users can create paychecks, process payroll, and other activities related to payroll, which are as follows.

- Handle HR and Payroll related tasks under one roof.

- You can take care of your team members by purchasing budget-friendly healthcare packages.

- Also, you can benefit from pay-as-you-go workers’ company insurance to safeguard your business.

- Utilize affordable retirement plans according to the latest guidelines combined with QuickBooks.

Contact Professionals!!

We hope you have gathered all the relevant details regarding QuickBooks Payroll Software 2024 through this write-up. However, consult our professionals if you want more details on using the payroll feature to process the company’s payroll. They will guide you in the best possible manner within shortest time possible.