QuickBooks Enhanced Vs Assisted Payroll: Which is the Best?

Payroll is one of the most important business activities requiring complete dedication and effort. Creating and processing the paychecks is tiresome, so organizations need software to simplify their work. Considering this, businesses prefer QuickBooks Payroll to process their employee’s payroll. However, it offers two different Desktop Payroll Editions, QuickBooks Enhanced Payroll and Assisted Payroll, to simplify payroll tasks. Furthermore, you must go through the following blog to know more about these editions and choose the appropriate payroll software edition for your company.

Are you confused which QuickBooks Desktop Payroll edition is best for your company, between Enhanced and Assisted Payroll? Contact us at +1(866)408-0544 to get Immediate resolutions to your queries.

A Quick Glimpse On the QuickBooks Enhanced Payroll

The QuickBooks Enhanced Payroll is the highly preferred software for those who deeply understand the payroll and are dedicated enough to meet the tax filing deadlines. Moreover, it is best for the small business owners having less than 50 employees.

Using the QuickBooks Payroll Enhanced software allows filing electronically, which helps enhance the speed of making tax payments. It also enables the users to manage various taxes, including State or Federal taxes.

Apart from this, it has made the process of computing paychecks, printing checks, and submitting direct deposits more convenient.

A Brief Introduction To QuickBooks Assisted Payroll

If you are looking for an advanced-level payroll management system, then QuickBooks Assisted Payroll software is the one you must go for. With this software, businesses don’t have to worry about filing penalties. This payroll software will file the tax forms and payments on your behalf on its own.

Moreover, by choosing it as your payroll software, you don’t have to think much about reviewing forms and hiring a payroll professional to handle all your payroll tasks. Within this QuickBooks Desktop Payroll software, you can enjoy all the premium features you won’t get in Enhanced and Basic versions.

However, if you still need clarification about which one you must go with, QuickBooks Payroll Enhanced or QuickBooks Assisted Payroll, look at the comparison below.

Comparison of QuickBooks Enhanced & Assisted Payroll

Below, we have discussed the comparison between QuickBooks Enhanced Payroll and QuickBooks Assisted Payroll. This will help you determine which payroll edition is best for your organization and streamline your company’s payroll activities. Let’s look at this table below to understand better the QuickBooks Desktop Payroll editions to make the right choice.

QuickBooks Enhanced Payroll |

QuickBooks Assisted Payroll |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Which Payroll Version QuickBooks is Good For Your Business?

The QuickBooks Desktop Payroll offers users two options: Enhanced and Assisted Payroll. Both offer extraordinary features that help streamline the company’s payroll processes. Among both the QuickBooks Enhanced Payroll editions, we recommend you go with QuickBooks Assisted Payroll. This payroll edition enables business owners to outsource the payroll tax administrations.

Conversely, with the Quickbooks Enhanced Payroll, you can handle all the tax payments and tax form submission requirements. With this, you can reduce the burden of filing the payroll taxes alone. Thus, it allows the users to concentrate on developing their business and spending less time on payroll administration tasks.

Before purchasing any QuickBooks Desktop Payroll, remember that Assisted Payroll is more expensive than Enhanced Payroll. Also, you will utilize this software if you have purchased the highest package of QuickBooks Desktop Enterprise, i.e, the Diamond Tier.

However, if budget isn’t a big problem for you, and your business is in two states where you can’t access this plan, go with the Assisted Payroll.

Simple Procedure to View My PayCheck Intuit In QuickBooks WorkForce

Now, with the View My PayCheck Intuit feature, users can easily view or download their employee’s pay stubs. There are two different ways to view your paystubs; either you can do it through the QuickBooks WorkForce app or via the QuickBooks Workforce web browser. Below, we have explained the procedure for both of them; apply the steps accordingly.

Alternative 1: View My PayCheck Intuit Via QuickBooks WorkForce Application

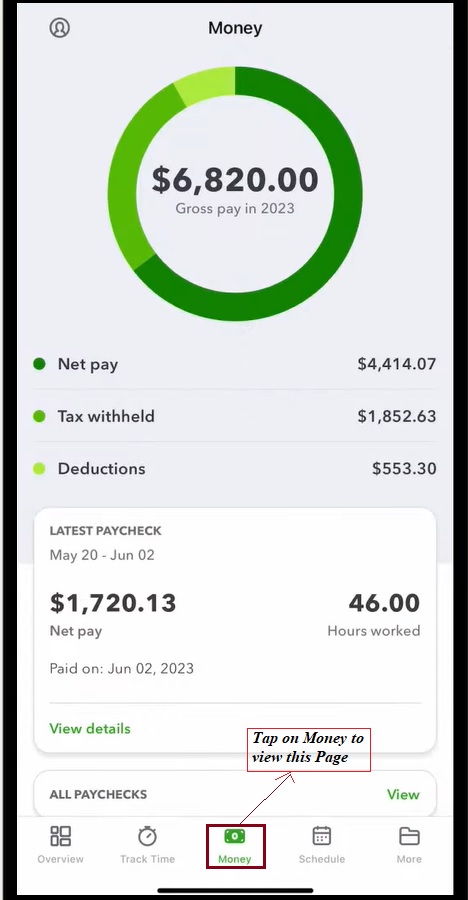

- Begin viewing your paycheck by clicking on the Money option.

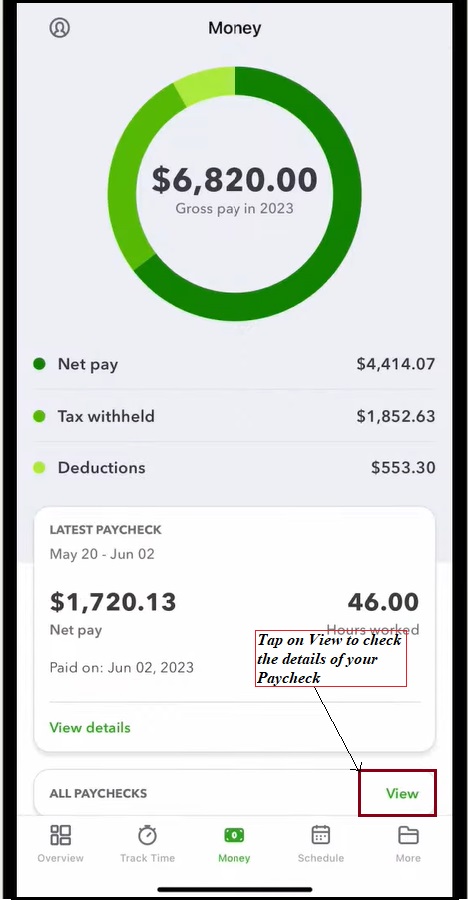

- Afterwards, hit the highlighted “View” tab to view all the current pay stubs from the Latest pay checks.

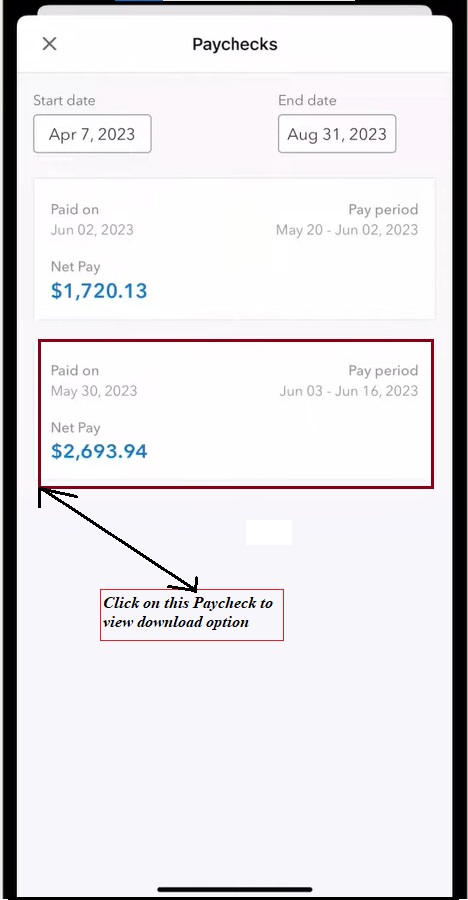

- In the next step, tap on any pay stubs to move ahead.

- Thereon, you can now view download button for your preferred Paycheck.

- Now, click on the pay stub you wish to view from the options available.

Alternative 2: View My PayCheck Intuit Through QuickBooks WorkForce Web Browser

- Before proceeding further, ensure that you have set up your Workforce account. If not, then first set it up to continue further.

- After this, you must login to your Workforce account by inserting “Workforce.intuit.com” into the address bar.

- Once you get into the Workforce account, choose the highlighted Paychecks option.

- You are supposed to pick the accurate Date Range although you may also go through the list of multiple paychecks that last up to one year at a time.

- Thereon, you can pick any of the following;

- Hit the Download button on the pay stub that you prefer to download.

- Pick a pay stub you want to open, view, download, and print if required.

- Tap the Download option if you wish to download all the paystubs together. Herein, you must remember that this option isn’t available for everyone.

Wrapping It Up!!

Through this post’s help, we hope you know the difference between QuickBooks Enhanced Payroll and QuickBooks Assisted payroll. However, if you are still chasing while picking the payroll software, then you must consult with our QuickBooks professionals through live chat or email support facility. They will guide you with the sure-shot solutions to overcome the issue instantly.

Frequently Ask Questions (FAQs)

What is the Procedure to Activate QuickBooks Enhanced Payroll?

After buying the QuickBooks Enhanced Payroll, you will obtain a Service key for activation. Follow the steps below to activate the Enhanced Payroll.

- Go to the Employees menu, hit Payroll > Enter Service Key option.

- You will be asked whether you wish to include this file in your payroll subscription for the existing payroll users.

- After this, click the Add button and include the Service key to move further.

- You will get an Activation confirmation message on your system and hit the Finish option.

What is the Price of the QuickBooks Desktop Payroll?

The QuickBooks Desktop Payroll price may begin from $ 50 per month, including $ 5 per employee. Also, you can get a pricing plan of $ 500 per year, including $ 5 per month per employee for the annual subscription.

What are the steps to Set up Workforce in QuickBooks?

The users will receive an email reminder whenever the pay stub is available. Follow the instructions outlined below to set up Workforce.

- Firstly, browse to the workforce.intuit.com using your preferred web browser.

- After this, navigate to the Settings menu > Email Notification.

- Thereon, you must choose the Send me email when new pay stubs are available.

What are the benefits of QuickBooks Basic Payroll Service?

The QuickBooks basic Payroll service is the best for entry-level payroll management. Moreover, a CPA should simplify the task of manually computing the payroll taxes. Using this payroll software, you can only access the basic functions, and won’t allow you to pay the 1099 form of employees.

Is QuickBooks Desktop Payroll going to phase out?

Yes, the additional services for the QuickBooks 2020 version of QuickBooks Desktop Payroll will be discontinued by 31st May 2023. The users can only access the payroll services for any QuickBooks version starting from 2021 and its higher editions.

Recent Posts

Why is My QuickBooks Desktop Running Slow? Here’s How to Fix

Read MoreHow to Get in Touch with QuickBooks Live Bookkeepers? Easy Guide

Read MoreHow To Fix QuickBooks Multi-User Mode Problems: H202?

Read MoreGet Started with QuickBooks Payroll Setup For Easy Tax Filing

Read MoreRun QuickBooks For Small Business & Simplify Your Finances

Read More